A sharp political stalemate has gripped the nation, leading to substantial volatility in the financial markets. Investors are growing increasingly anxious as policy crucial to business confidence remains stalled. The absence of guidance from policymakers has driven uncertainty, causing fluctuations in asset values.

- Analysts/Experts/Commentators are warning/cautioning/advising against making drastic decisions/investing recklessly/entering risky ventures during this period of turmoil/instability/uncertainty.

- The current situation/political deadlock/economic climate has the potential to/likelihood of/capacity for further disrupting/impacting/shaping the markets in the coming weeks/short term/immediate future.

- Government officials/Party leaders/Political figures are urging/appealing/calling upon both sides to find common ground/reach a compromise/resolve the impasse to restore confidence/prevent further damage/stabilize the economy.

Bitcoin Enthusiasts Drive to New Heights Despite Regulatory Clouds

Despite ongoing regulatory/legal/governmental uncertainty surrounding the digital/copyright/virtual asset, Bitcoin bulls/investors/traders are driving/pushing/propelling prices/valuations/market capitalisation toward record highs. Analysts/Observers/Experts point to a combination/blend/mix of factors including/comprising/entailing growing institutional/mainstream/public adoption/acceptance/involvement, increasing/growing/expanding demand/interest/popularity, and a belief/a perception/a feeling that Bitcoin/copyright/the blockchain will eventually/ultimately/sooner or later emerge as a dominant/leading/prevalent form/mode/asset of payment/value transfer/finance. website However/Nonetheless/Despite this, the future/trajectory/direction of Bitcoin/copyright/digital assets remains uncertain/volatile/murky in the face of potential/possible/upcoming regulations/legislation/laws from governments/authorities/jurisdictions around the world/globe/planet.

Tech Giants Face Antitrust Scrutiny in Landmark Court Case

In a landmark legal/judicial/court battle that could reshape the tech industry landscape, major/leading/dominant tech giants are facing intense/steep/unprecedented antitrust scrutiny. Federal/State/International regulators are levying/bringing/filing charges against these companies/corporations/conglomerates, alleging anticompetitive/monopolistic/abusive practices that harm/stifle/limit competition and consumers/users/businesses. The case/lawsuit/proceeding has sparked/ignited/generated intense debate about the role/influence/power of these tech titans and the need for regulations/oversight/reform in the digital age.

Startup Funding Dwindles as Investors Demand Stability

The once vibrant landscape of startup capital is facing a dramatic slowdown. Investors, after a period of frenzied spending, are now embracing stability and prudence. This shift in sentiment has led to a decline in available capital for early-stage companies. , Due to this, startups are finding it challenging to secure the resources they need to flourish.

- Several investors are now shifting their attention to later-stage companies with a proven track record of success.

- Various are increasingly selective when it comes to investment decisions, requiring stronger momentum.

- Present climate is creating a new wave of innovation within the startup world, as companies are forced to find creative solutions to navigate the uncertainties.

Global Inflation Fears Resurface, Weighing on Business Confidence

Persistent economic/fiscal/monetary uncertainty and surging commodity prices/inflation rates/cost of living are reinforcing/fueling/heightening concerns about a global inflationary spiral/price surge/economic downturn. Market analysts/Economists/Business leaders caution/warn/predict that this renewed pressure/volatility/threat on prices could severely hamper/significantly impact/negatively affect business confidence/growth/outlook, leading to reduced investment/slower hiring/scaled-back expansion. Furthermore/Additionally/Moreover, rising interest rates/tightening monetary policy/government austerity measures are adding to the strain/exacerbating the situation/compounding these challenges, creating a toxic/uncertain/volatile environment for businesses to thrive/operate/plan.

- Consumers/Businesses/Investors are becoming increasingly cautious/shifting spending habits/re-evaluating investments in response to the economic climate/inflationary pressures/rising cost of living.

- Supply chain disruptions/Geopolitical tensions/Energy price volatility are further exacerbating inflationary pressures/contributing to market instability/adding complexity to the economic landscape.

- The global community/international organizations/financial institutions are monitoring the situation closely/implementing policies to mitigate risks/working to restore stability.

releases New Infrastructure Plan

The Biden Administration yesterday released a ambitious new infrastructure plan designed to transform the nation's bridges. The multi-billion dollar proposal targets repairing aged infrastructure while in addition investing in clean energy.

The initiative is expected to create thousands of positions and strengthen the marketplace.

Keypillars of the plan include:

- Investing in transportation infrastructure, such as roads, bridges, and airports

- Improving connectivity| broadband internet service

- Addressing climate change

- Modernizing sanitation systems

The plan faces concerns from some Republicans who criticize its cost. However, the Biden Administration is optimistic that the infrastructure plan will be essential for the nation's future.

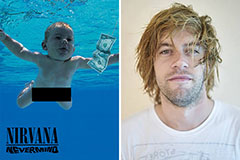

Spencer Elden Then & Now!

Spencer Elden Then & Now! Kane Then & Now!

Kane Then & Now! Justine Bateman Then & Now!

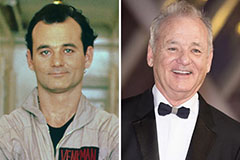

Justine Bateman Then & Now! Bill Murray Then & Now!

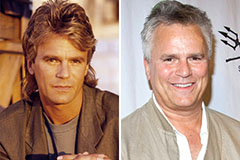

Bill Murray Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!